AKcess is a technology company providing digital identity management and eKYC solutions aimed at Financial Institutions (e.g. central, commercial and online banks), SMEs, and other sectors such as Healthcare, Real Estate, and Education, via a private blockchain platform.

Our app is a digital wallet where users can store, create, verify, and securely share a range of documents, identities, and personal data. AKcess provides top-notch data security by encrypting your data, hashing it, and ensuring that it can only be viewed by institutions and individuals you grant access to.

We provide a full Digital Onboarding and Verification solution, with an eKYC platform that helps enterprises, institutions, governments and customers share documents and data, save time, energy and money.

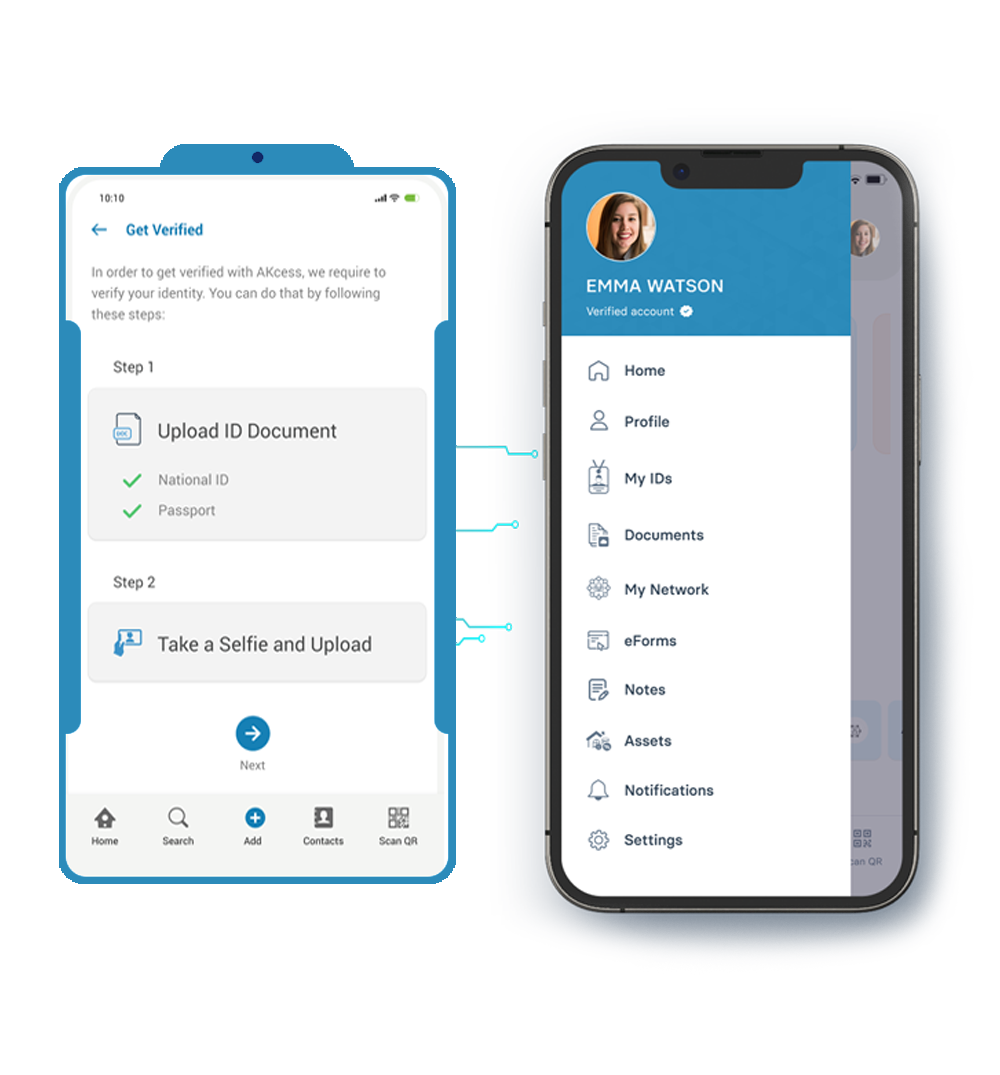

User downloads AKcess app and signup using their Email and Mobile Number, and inputs their profile data (KYC fields)

AKcess users can get Verified by uploading an Identity Document and taking a selfie, or through a Verifier (Government Entities, Financial Institutions, Telecoms, Universities, Credit Agencies, and other global Verifiers…). AKcess is an aggregator of Verifiers, connecting to various data sources to perform CDD, EDD and AML checks on the go.

With AKcess, onboarding becomes a one-click process. Users can own and manager their KYC, and share information and documents with any Institution privately and securily using AKcess solutions.

Users share information and documents using our eForms, or with the QR code via the app. Users can also sign Documents digitally, and institutions would receive all submitted information, which is sent with completed forms, signatures, and any additional required data.

Both Users and Institutions would have the latest KYC data on file. Other stakeholders can also benefit from this, and get automatic updates with the User’s consent. Users can also push updates to other institutions they deal with, and reuse Verified KYC data.

AKcess app give users control over who has access to their data and documents while emphasizing transparency, privacy, and security.

Through AKcess, users can create, store, and update their KYC, identity documents, other documents and profile data. All data is encrypted, and immutably added to the underlying private blockchain, and can be verified by AKcess or other Institutions and Verifiers.

Users then have the ability to receive and respond to eForms from various organizations to securely submit documents and data. Organisations can also request temporary access to verify their identity and perform AML checks, Face Matching and Biometrics, Proof of Address, PEPs, Sanctions, Adverse Media, and in-depth due diligence. This can also be used to automate identification verification that may be needed for any digital process while complying with AML and CTF laws and regulations.